Alain Butler l ’expert en matières agricoles de BNP Paribas (Suisse) à Genève met en avant la concentration du marché agricole pour expliquer la récente hausse du prix des matières premières.

Alain Butler ne croit que ce qu’il voit. C’est pour cela qu’il passe la plupart de son temps sur le terrain, à la rencontre des acteurs du secteur agricole. La confrontation entre sa connaissance des marchés globaux et son ancrage dans la réalité des marchés physiques lui confère ainsi une légitimité toute particulière pour évoquer la hausse des prix actuelle. Réfutant la thèse de l’importance de la spéculation sur la direction des prix, il apporte un éclairage pratique aux développements du secteur.

La concentration géographique des zones de production est selon lui l’une des causes majeure de la volatilité des cours car elle les rend vulnérables au moindre incident climatique ou trouble politique. Mais il affirme que la tendance actuelle est à la déconcentration. D’une part, les investisseurs veulent diversifier leurs risques en privilégiant la complémentarité géographique, au travers des petits pays producteurs. D’autre part, les gouvernements des pays émergents ont dépassé le paradigme des cultures d’exportation pour enfin développer les cultures vivrières. Cette double dynamique devrait donc à long-terme permettre une baisse naturelle la volatilité des cours en assurant un approvisionnement plus constant du marché mondial

ENTRETIEN

Les origines structurelles de la flambée des prix

. Les facteurs conjoncturels n’expliquent pas à eux seuls l’envolée des denrées dans le monde .

Olivier Pellegrinelli /Agefi En quoi la hausse du prix des matières premières agricoles actuelle diffère-t-elle de 2007-2008?

Alain Butler. (BNP Parribas Suisse). Il y a quatre ans, c’était la première fois que le monde était confronté à une telle envolée des prix.

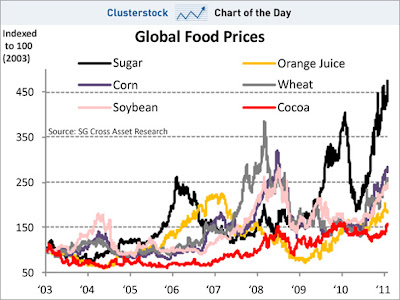

L’importance relative des facteurs qui ont pu contribuer au-delà des mauvaises récoltes qui ont précédé à cette augmentation agressive des cours – notamment, intervention des fonds d’investissement, développement des biocarburants et incertitudes macroéconomiques – est toujours débattue aujourd’hui par les experts. Il est probable que certains de ces facteurs jouent toujours un rôle dans la hausse actuelle mais le déclencheur incontestable a été la brusque détérioration de l’offre liée à de mauvaises récoltes causées par des sécheresses en Russie et en Argentine, ou des inondations en Australie et au Pakistan. Cette baisse de disponibilité s’est de plus matérialisée simultanément sur la majorité des matières premières agricoles.

Quel rôle le pétrole joue t-il dans la fixation des prix agricoles?

Il est certainement moins important que pour d’autres matières premières. Les cours du pétrole influencent bien entendu les coûts de production agricoles, mais les marchés agricoles répondent à une demande relativement captive et, une fois produites, elles doivent in fine être vendues peu importe leur coût de production car elles sont périssables. La demande en produits agricoles est relativement prévisible, contrairement à l’offre qui peut fluctuer fortement d’une année à l’autre, ce qui rend les cours vulnérables à de fortes hausses ou à des baisses.

Comment les marchés des contrats à terme influencent-ils les cours physiques?

Aujourd’hui, les marchés agricoles sont mondiaux et les interactions entre chaque région de la planète sont toujours plus importantes. Les prix locaux sont donc fortement influencés par les prix internationaux. Les contrats à terme reflètent principalement l’anticipation des cours futurs. Certains producteurs utilisent également leur connaissance des cours à terme pour décider quelles cultures planter et ainsi maximiser leur profit. L’influence est donc réciproque entre les cours des contrats à termes et ceux des marchés physiques.

La présence des fonds d’investissement sur les contrats à terme constitue-t-elle un facteur de volatilité important?

L’activité des fonds d’investissement peut avoir un effet amplificateur à court terme mais en aucun cas elle ne peut fixer la direction des cours. Ce sont toujours les déséquilibres physiques et leur interprétation par les acteurs de marché qui se trouvent à la base du mécanisme qui fixe l’orientation des prix. Ainsi, les positions dites « spéculatives « ne peuvent à elles seules expliquer l’augmentation du prix des matières premières et n’ont qu’une influence relativement limitée sur le niveau absolu des prix à long terme.

Quels autres facteurs contribuent à augmenter la volatilité des cours?

Incontestablement, la gestion de l’information a un rôle fondamental dans la volatilité quotidienne des cours. Depuis l’émergence d’internet et de la téléphonie mobile, l’information circule beaucoup plus vite, même dans les régions productrices parfois reculées. Les agriculteurs peuvent donc réagir face aux cours mondiaux, en négociant leurs prix, voire en stockant plus longtemps une partie de leur récolte si leur liquidité le permet. De plus, du fait de la diffusion rapide de l’information, des simples effets d’annonce peuvent avoir des implications beaucoup plus importantes sur les cours. Quand le département américain de l’agriculture publie son rapport mensuel, toute la chaîne de valeur y a accès au même moment. Il y a plus d’une dizaine d’années, l’environnement n’était pas propice à une telle vitesse de diffusion de l’information.

Pourquoi les matières agricoles telles que le cacao, le coton ou le sucre ont-elles flambées récemment?

Il s’agit là aussi de l’augmentation de l’incertitude liée à l’offre à court et moyen termes de ces denrées. Toutes ces cultures sont de plus extrêmement concentrées géographiquement, ce qui rend les cours mondiaux sensibles vis-à-vis des évènements climatiques et politiques dans les grands pays producteurs. Cette année, la crise ivoirienne pour le cacao ou le gel en Floride pour le jus d’orange, en sont de parfaits exemples. Dans le cas du coton, il faut savoir que des producteurs avaient fortement réduit leurs surfaces cultivées parce que le soja était relativement plus rentable. Au moment de la reprise économique, l’offre s’est retrouvée largement déficitaire pour répondre à une nouvelle demande globale de textile liée à la reprise économique ce qui a poussé les prix du coton vers le haut.

Comment voyez-vous l’évolution de ces marchés à moyen terme?

Les cultures en général vont selon moi connaître un phénomène de déconcentration dans les années à venir. Suite à la crise alimentaire de 2007/2008, les gouvernements des pays en voie de développement sont en train de favoriser les cultures vivrières destinées à l’autosuffisance alimentaire, au détriment des cultures de rentes destinée à l’exportation et autrefois encouragées par le consensus de Washington. De plus, les investisseurs cherchent à réduire leurs risques en diversifiant l’origine géographique de leurs produits. Cette tendance va donc contribuer à diminuer la volatilité des prix car elle réduira l’importance des événements climatiques et politiques.

La corrélation de prix entre chaque matière première a considérablement augmenté depuis quelques années. Pourquoi?

Les cours sont plus corrélés qu’avant car les opportunités pour substituer les denrées à d’autres sont beaucoup plus nombreuses. Plus les marchés grandissent, plus les acheteurs finaux trouvent les opportunités de remplacer un tourteau de soja par un tourteau de colza par exemple. De même, plus la capacité industrielle de transformation des denrées augmente, plus la flexibilité pour saisir ces opportunités est grande. Le fait que le financement des marchés agricoles soit de mieux en mieux organisé favorise aussi des opportunités de substitution. Ainsi, comme dans les principes fondamentaux de l’économie, plus les produits agricoles deviennent substituables, plus leurs prix seront corrélés.

interview:

Olivier Pellegrinelli /Agefi

EN COMPLEMENT : La crise libyenne fait plonger le prix du coton

La livre de fibre blanche, qui valait encore 75 cents début 2010, avait bondi à plus de deux dollars la semaine précédente les opérateurs s’inquiétant de la faiblesse de l’offre sur la planète

Les prix du coton se sont fortement repliés cette semaine à New York, entraînés par les angoisses des marchés financiers alors que la crise libyenne tournait à la répression sanglante et entraînait une envolée des cours du pétrole.

«Les spéculateurs ont semblé soudain pressés de retirer de l’argent de la table», ont commenté les analystes de la maison de courtage Plexus Cotton. «Ce qui devait être une relativement faible correction a pris une forte ampleur, surtout en raison de l’incertitude sur le front géopolitique», ont-ils ajouté.

Le marché du coton est particulièrement sensible à la conjoncture économique et connaît régulièrement de fortes variations en fonction de la confiance des investisseurs en la reprise économique.

La perspective d’une crise majeure au Moyen-Orient a donc concentré toutes les inquiétudes, de même que l’envolée des cours du pétrole, qui si elle se prolongeait pourrait constituer un choc important pour l’économie mondiale.

L’indice Cotlook A, moyenne quotidienne des cinq prix du coton les plus faibles sur le marché physique dans les ports d’Orient, retombait vendredi à 209,30 dollars (pour 100 livres), contre 233,50 dollars en fin de semaine précédente soit une baisse de 10%…Le Prix de la spéculation ?